Financial Planning

What is PAN?

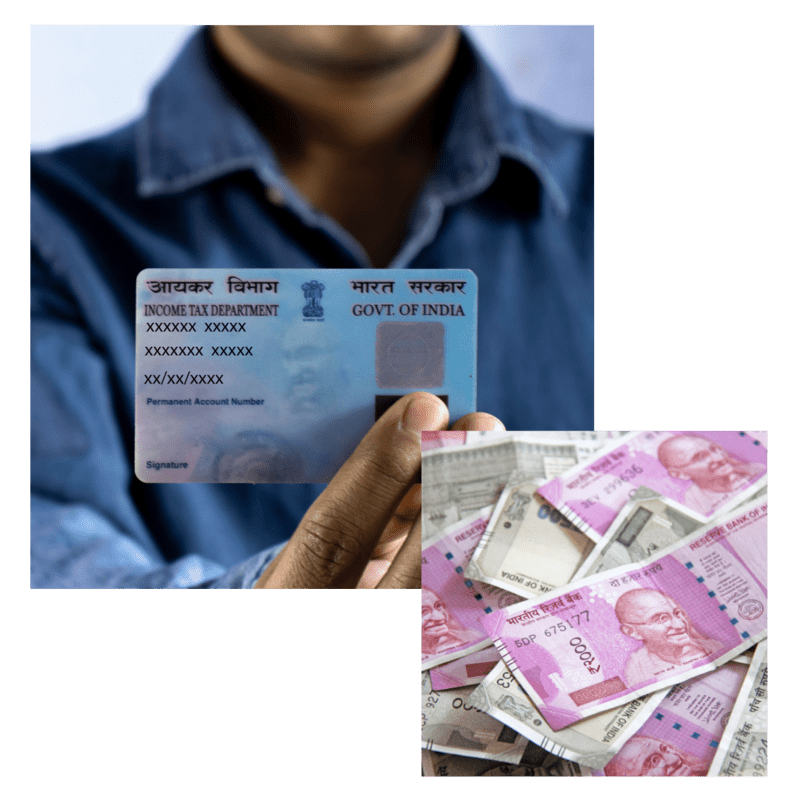

PAN is a ten-digit unique alphanumeric number issued by the Income Tax Department. PAN is issued in the form of a laminated plastic card as given below (commonly known as PAN card):

PAN enables the department to identify/ link all transactions of the PAN holder with the department. These transactions include tax payments, TDS/TCS credits, returns of income, specified transactions, correspondence etc, and so on. It facilitates easy retrieval of information of PAN holder and matching of various investments, borrowings and other business activities of PAN holder.

Apply for PAN/TAN

Every person if his total income or the total income of any other person in respect of which he is assessable during the year exceeds the maximum amount which is not chargeable to tax.

- A charitable trust who is required to furnish return under Section 139(4A)

- Every person who is carrying on any business or profession whose total sale, turnover, or gross receipts are or is likely to exceed five lakh rupees in any year

- Every person who intends to enter into specified financial transactions in which quoting of PAN is mandatory.

Every non-individual resident persons and persons associated with them shall apply for PAN if the financial transaction entered into by them during the financial year exceeds Rs. 2,50,000.

Leave us a message

If you have any queries or want to consult us, feel free to contact us. We would love to hear from you.